In general

STIFA is assigned extensive responsibilities relating to the supervision of both common-benefit and private-benefit foundations.

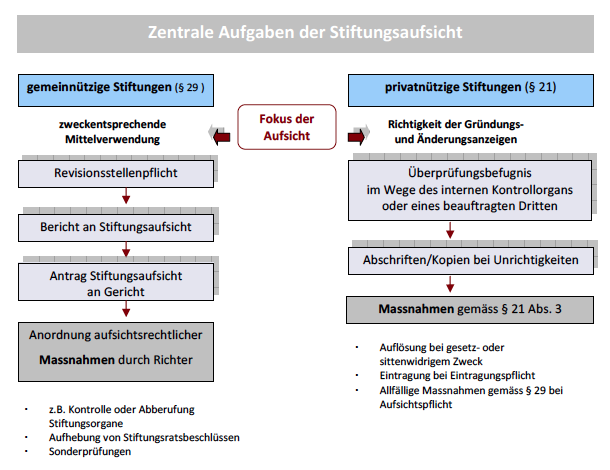

The supervisory regime makes a basic distinction between common-benefit (non-profit) foundations, which are subject to public supervision by law in accordance with article 552 § 29 of the Persons and Companies Act, PGR (Art. 552 § 29 of the Law on Foundations, PGR), and private-benefit foundations, which either are subject to supervision pursuant to a provision in the foundation deed or whose notifications of formation and amendment may be verified for accuracy by STIFA in accordance with Art. 552 § 21 PGR.

Where foundations have both common-benefit and private-benefit purposes, supervision is obligatory if the common-benefit purpose predominates.

Graphical overview

Common-benefit (non-profit) foundations

Common-benefit purposes are those whose fulfilment is of benefit to the general public. In particular, this is the case if the activity serves the common good in a charitable, religious, humanitarian, scientific, cultural, moral, social, sporting or ecological sense – even if only a specific category of persons benefits from the activity (article 107(4a) PGR). Accordingly, a common-benefit foundation within the meaning of the Law on Foundations is a foundation whose activity according to the declaration of establishment is entirely or predominantly intended to serve the abovementioned purposes, unless it is a family foundation.

The comprehensive focus of the supervision of common-benefit foundations serves to verify the management and appropriation of the foundation assets in accordance with their purposes. STIFA has the ex officio responsibility to ensure that foundation assets are managed and appropriated in accordance with their purposes; in performing this responsibility, it draws on an audit authority, which every foundation subject to STIFA supervision necessarily has to set up. The audit authority is appointed by the court in special non-contentious civil proceedings. The audit authority is under an obligation to verify once a year whether the foundation assets are being managed and appropriated in accordance with their purposes. It must submit a report on the outcome of this audit to STIFA. Exceptions to the obligation to appoint an audit authority are provided in Art. 552 § 29 PGR in conjunction with articles 5 and 6 of the Foundation Law Ordinance (StRV).

On the basis of the audit authority’s report or, in the case of foundations exempt from the obligation to appoint an audit authority, on the basis of the audit carried out by STIFA itself, STIFA decides whether supervisory measures are necessary. It does not decree these measures itself, however, but rather applies to the court in special non-contentious civil proceedings.

The law enumerates possible measures by way of example, such as the control and dismissal of the executive bodies of the foundation, cancellation of resolutions of executive bodies of the foundation, and carrying out of special audits.

Furthermore, to oppose asset management and appropriation by the executive bodies of the foundation conflicting with the purpose of the foundation, each foundation participant may apply directly to the court for an order for supervisory measures. In such proceedings, STIFA has the status of a party.

STIFA likewise has the status of a party in other judicial supervisory proceedings initiated on the request of foundation participants, such as proceedings to amend the purpose of the foundation or other contents of the foundation deed.

Excursus on tax law

The definition of common-benefit purposes in the Liechtenstein tax law is also governed by article 107(4a) PGR. Further material prerequisites must be met to apply for exemption from direct taxation, however: The common-benefit purpose must be pursued exclusively and irrevocably, as specified in the articles. Furthermore, the foundation is required to actually operate in accordance with its stated purpose. Mere asset management as the actual activity with no or only minor contributions to common-benefit purposes is not sufficient, and the administration costs must be reasonable. In the event of dissolution, the assets must be assigned exclusively to the common-benefit purpose.

Private-benefit foundations

A private-benefit foundation is a foundation which, according to the declaration of establishment, is entirely or predominantly intended to serve private or personal purposes (Art. 552 § 2(3) PGR).

For private-benefit foundations, STIFA has the power to verify the accuracy of the notifications of formation and amendment. For this purpose it may inspect the foundation documents through the controlling body internal to the foundation or, if no such body has been set up, through an authorised third party, insofar as this is necessary for verification purposes. If the verification indicates that the notification of formation or amendment is inaccurate, duplicates and copies may be drawn up, on the basis of which STIFA decides on the necessary measures.

Private-benefit foundations may also elect to place themselves under STIFA supervision in accordance with Art. 552 § 29 PGR, if so provided in the foundation deed.